Here’s what we have for you today:

• Foreign to domestic

• US mortgage dilemma

• Banks are fined

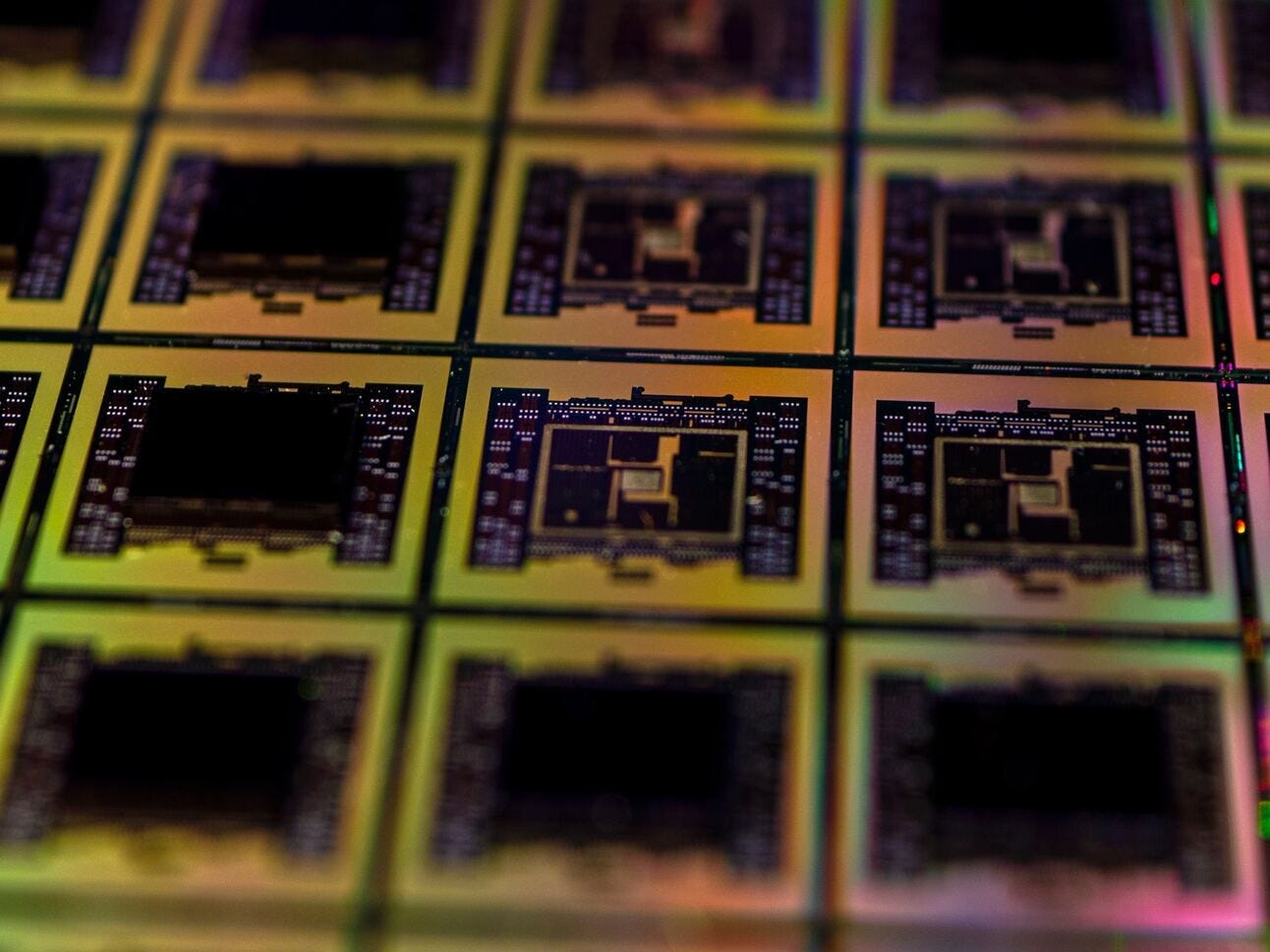

US chip sector short of talent

Foreign skills: A great number of the semiconductor supply chain is based overseas, which means there are fewer qualified workers to operate these facilities in the US.

Missing gap: The chip industry in the US is projected to grow by nearly 115,000 jobs by 2030. However, with 67,000 of those jobs possibly going unfilled by 2030 due to a lack of educational training programs and school funding, according to Oxford Economics and the Semiconductor Industry Association.

The delay: Taiwan Semiconductor Manufacturing Company, the largest contract chipmaker in the world, said it had to delay production at its $40 billion Arizona plant due to a lack of workers in the US.

Property loan credit not available to many

The drop: Monthly index measuring credit availability dropped in July, 2023 to the lowest level since 2013.

Now: The average rate on the 30-year fixed mortgage is now hovering around 7% in August, 2023.

Reason: Decline in cash-out refinance programs was a major component of the overall drop in credit availability.

US hit banks with fines for evading regulators

Regulations: The Securities and Exchange Commission fined $289 million against 11 firms for “widespread and longstanding failures” in record-keeping, while the Commodity Futures Trading Commission also mentioned it fined four banks a total of $260 million for failing to maintain records required by the organization.

Going far: The biggest offender Wells Fargo, the fourth-largest US bank by assets racked up $200 million in penalties.

Purposely: Encrypted messages sent on third-party platform(s) makes it near impossible for banks to record and retain interactions. At Wells Fargo and other banks, the practice was prevalent and happening at all levels. Such as the managers responsible for enforcing the rules were guilty of the practice.