Here’s what we have for you today:

• E-commerce giant departs

• Another space company down

• American retail pricing

Alibaba demonopolizing

The start: Cainiao Network Technology Co., the logistics arm of Alibaba Group Holding Ltd., has begun preparations with banks for its Hong Kong initial public offering. Cainiao is currently valued at more than $20 billion.

The bankers: As alluded, banks including China International Capital Corp. and Citigroup Inc. are working with the company to prepare for the first-time share sale.

The separation: Alibaba unveiled plans to split its $250 billion business into six main units encompassing e-commerce, media and the cloud. Each business will explore fundraising or IPO at an appropriate time.

Virgin Orbit closing down

Space halt: Virgin Orbit Holdings Inc. a satellite-launch company tied to Richard Branson, is halting operations due to growing cash-crunch pressures that have paralyzed startups in many emerging technologies.

Zero gravity? The company said in a filing on 3/30/23 that it was cutting 675 jobs, or about 85% of its workforce, “in order to reduce expenses in light of the company’s inability to secure meaningful funding.” A spokesperson for Virgin Orbit said the remaining 15% of employees will work on winding down the business.

Last stand: Branson injected $10.9 million by buying a note convertible into shares through his Virgin Investments Ltd., allowing the failed business to fund severance pay and other costs, Virgin Orbit noted.

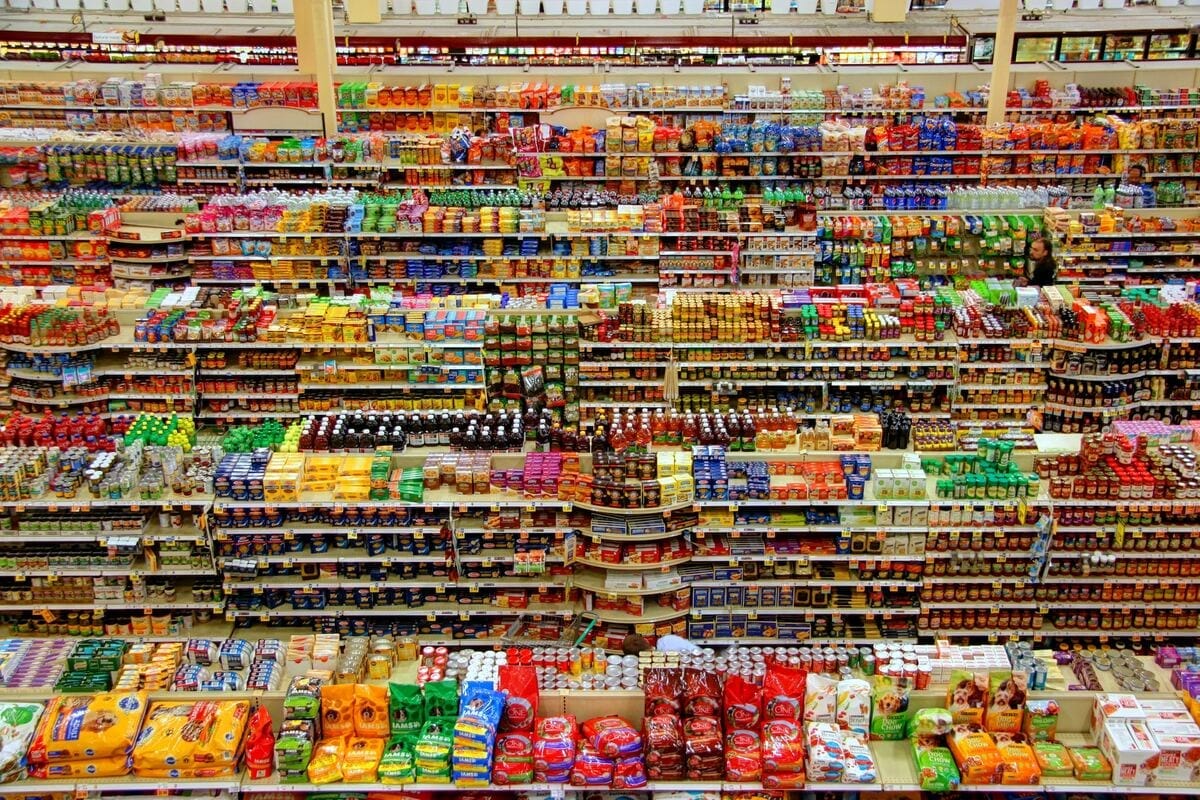

Retail inflation from the beginning

Price war: Walmart and Aldi had the lowest grocery prices across a range of products, from meat and seafood to packaged goods. Aldi was cheaper than Walmart in every category other than household and personal care goods.

2023 dollar stretch: At Dollar General, prices rose 36%, the steepest increase of all the retailers according to Bank of America analysts’ report. Whereas, at Kroger, prices rose 21%, roughly in line with food inflation since 2020.

Baseline: Across all food retailers, prices were 22% higher compared to three years earlier.

Become Our Royal Supporter!

Dear readers: We are grateful for having you as our reader, and do hope you will continue to enjoy our content as we try to bring the best foot forward.

What we do: Serving our readers with quality news on what’s happening economically.